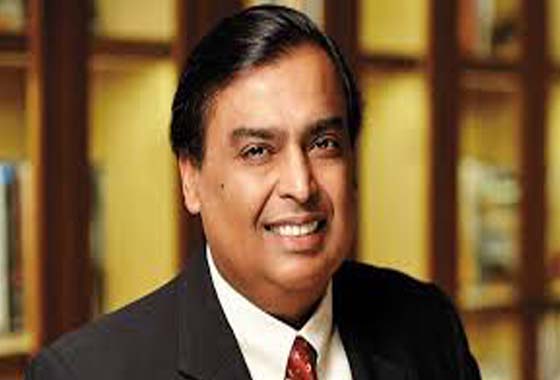

Reliance Chairman Mukesh Ambani Fulfilled his Promise: As it turns ‘zero- net-debt’ Co

“I have fulfilled my promise to share holders by making reliance net debt-free much before our original schedule of March 31st 2020-21”.

Mumbai: Reliance Industries crossed another mile stone on Friday as it surpassed the $ 150 billion capitalization mark. The company had “met its promise to share holders” by becoming net debt-free ahead of its March 2020-21 deadline, said its chairman Mukesh Ambani.

After a relatively decent start of the session, the RIL stock rally soon after Ambani’s statement and closed 6.5% higher, giving it an mcap of almost Rs. 11.5 lakh Crore on the BSE, translating into $ 151 billion. From sinking to a multiyear low of Rs. 868 on March 23 this year, the stock hit a high of Rs. 1789 during Friday’s session, after its chairman Mukesh said.

“I have fulfilled my promise to share holders by making reliance net debt-free much before our original schedule of March 31st 2020-21”. RIL’s closest rival in terms of mcap is software exporting major TCS at Rs. 7.75 lakh crore followed by HDFC bank at Rs. 5.7 lakh crore and HUL at Rs. 4.9 Lakh crore. The strong rally in RIL on Friday an index heavy weight, also sent to the Sensex to a three months closing high at 34,732 points as a bench mark gained 524 points.

Last August at RIL’s annual share holder meeting, chairman Ambani, who is now the 9th richest person in the world. According to Forbes magazine, had pledged that he will slash the company’s net debt to zero by the end of physical 2020-21. A ‘zero net debt’ status is attained when a company’s cash equals the debt on its book. RIL has secured investments commitments of Rs. 1.75 lakh crore through share sales in digital and petro retails units in December starting, and also through Rs. 53,124 rights offer to its existing share holder, the largest over in India.

The combined fund mobilization is in excess of reliance’s net debt of Rs. 1.61 lakh crore.